As the resurgence of Trump‑era “America First” protectionism—complete with tariffs, supply‑chain shifts, and investor jitteriness—grips the US, global market volatility has surged. While tariffs aim to repatriate jobs and capital, history shows they wreak havoc instead: disrupted trade, imported inflation, and unsettled currencies. The upshot? A fresh wave of capital flight, as global investors seek stable, yield-rich alternatives—chief among them: UK real estate debt.

Why Protectionism Sparks Capital Flight

Markets crave predictability—but trade wars offer the opposite. Tariffs inflate costs, squeeze profit margins, and unsettle currencies, destabilising returns. As geopolitical alarms ring and domestic financing tightens, savvy investors hunt for safe havens. Enter the UK.

Thanks to its transparent legal system, regulatory clarity, and robust protections, the UK is quietly becoming a global base for dollar‑denominated investment—without a hefty tax burden. UK real estate debt is emerging as a stand‑out asset class.

Understanding Real Estate Debt

Real estate debt sits at the sweet spot between capital preservation and yield. Instead of betting on price growth (as with equities or direct ownership), investors fund loans against physical property—structures like commercial blocks or residential developments—typically at conservative loan‑to‑value (LTV) ratios. In return? Fixed interest payments and principal protection.

Platforms like ASK Partners have digitised access to this asset class, enabling investors to back UK property loans—without managing tenants or fluctuating valuations. This appeals particularly to time‑constrained, financially empowered investors, offering passive returns and control without the distractions of brick‑and‑mortar ownership.

How the ASK Platform Works

- Access via a digital portal to loan-by-loan investment.

- Loans underwritten by ASK against residential, commercial & mixed-use projects.

- Transparent terms, fixed yields, and capital return at maturity.

- Secondary market enables trade‑ability—adding liquidity to real estate debt.

A Compelling Shift in Capital Deployment

As traditional lenders shy away from development projects and debt maturities loom (UK loan maturities totaling over £32 billion in 2025) :contentReference[oaicite:1]{index=1}, real estate debt platforms are stepping in. They bridge market gaps, offering construction & refinancing capital often overlooked by mainstream banks.

As noted in Europe’s 2025 debt roundtable: “tariff‑induced market turmoil may … divert capital flows toward Europe” :contentReference[oaicite:2]{index=2}. With a dynamic supply‑constrained UK housing landscape and resilient rental market, that diversion is visible in growing interest in UK real estate debt.

According to Aberdeen Investments, UK real estate delivered an 8.1% total return through early 2025, with retail, industrial, living, and hotel sectors outperforming :contentReference[oaicite:3]{index=3}—a perfect backdrop for income‑focused lenders.

UK Market Stability in 2025

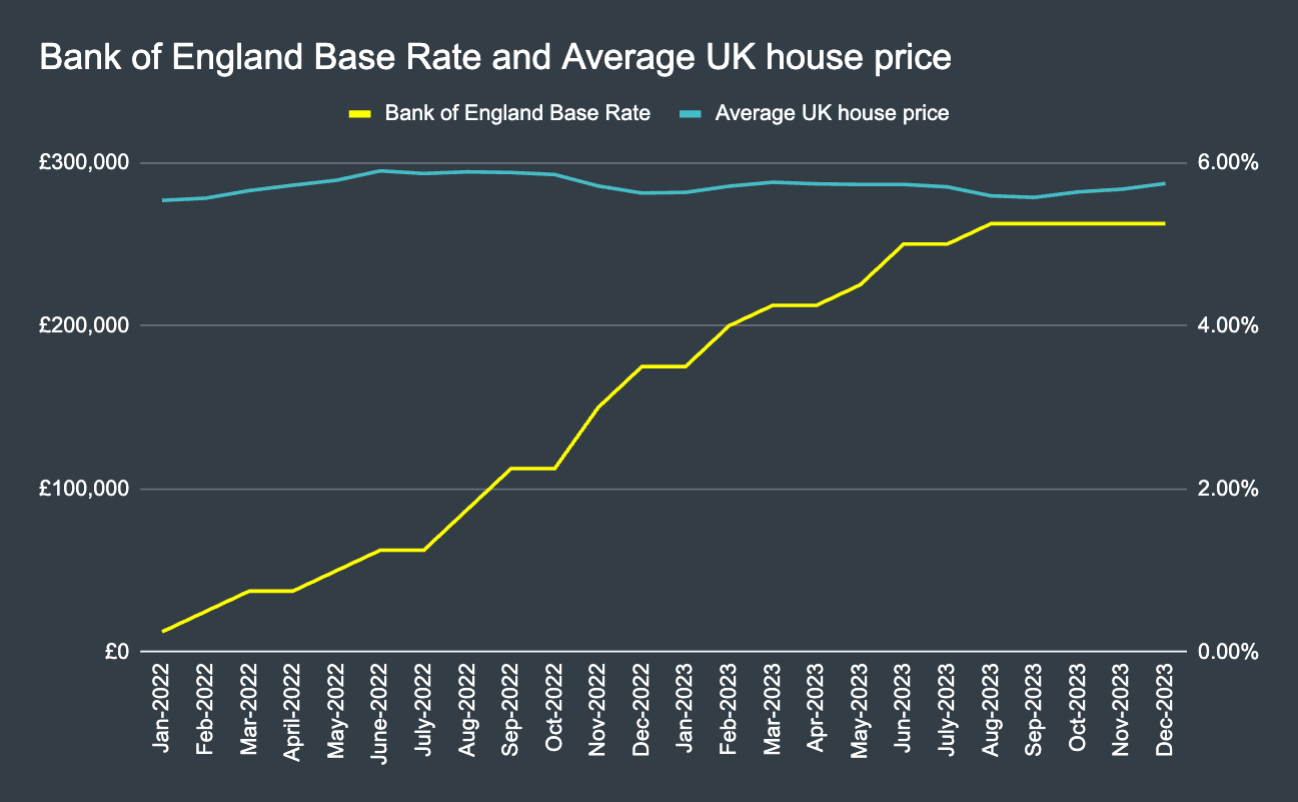

Despite sticky stamp duty, interest rates, and inflation, the UK housing market remains relatively stable:

- House prices flat in June 2025 (Halifax: £296,665, –0.3%) :contentReference[oaicite:4]{index=4}

- Weak yet steady job market with unemployment ~4.5% :contentReference[oaicite:5]{index=5}

- Expectations of interest rate cuts—supporting mortgage affordability :contentReference[oaicite:6]{index=6}

This sluggish yet stable outlook reinforces the attractiveness of predictable debt returns over equity‑like speculation.

Why UK Real Estate Debt Is Gaining Traction

- Predictable income: Fixed interest, regular cash flow, principal return.

- Lower volatility: No direct exposure to equity price swings.

- Focused due diligence: Loan underwriting and borrower scrutiny.

- Secondary market liquidity: Platforms like ASK offer tradeable loans—rare in direct debt.

- Strategic diversification: Real estate debt adds diversification to portfolios.

Role of ASK Partners

Since 2016, ASK has deployed £1.95 billion across 155+ transactions :contentReference[oaicite:7]{index=7}. Key highlights:

- Specialist in bridging, development, and exit loans for UK property.

- Loans funded by a diverse investor base—institutions, family offices, HNWs.

- Innovative secondary market platform enabling over £45 million in trade volume :contentReference[oaicite:8]{index=8}.

ASK fills in the lending gap left by banks, offers flexible underwriting (e.g. no strict interest coverage ratio), and supports development finance, including planning‑stage projects :contentReference[oaicite:9]{index=9}.

Targeted Investors—Especially Women

The narrative isn’t just institutional or male investors—ASK notes a rising tide of female investors seeking clarity, autonomy, and dependable returns. Real estate debt simplifies that equation: no tenants, no repairs, just transparent loan terms and consistent cash flows.

Risk & Regulation Checks

While nuisance-free, real estate debt still holds risk:

- Developer failure or execution risk: Mitigated by conservative LTV caps.

- Market downturns: Loan value secured by physical assets.

- Interest rate changes: Fixed-rate structures prevail.

- Regulatory shifts: UK sustainability directives, e‑efficiency, planning sensitive—but ASK diligence adapts :contentReference[oaicite:10]{index=10}.

The Bigger Picture & Outlook

Across Europe, real estate debt is rising up investor agendas:

- PERE reports rising competition, but cautious underwriting hitting LTV & covenants :contentReference[oaicite:11]{index=11}.

- JLL underscores $3.1 trn of maturing debt globally—creating openings for debt lenders :contentReference[oaicite:12]{index=12}.

In this landscape, the UK shines—deep rents, stable legal frameworks, and resilient inflation-hedged growth. As Trump-era instability roils global flows, UK real estate debt is emerging as a beacon of calm.

Conclusion: Time to Rebalance Portfolios

Trump‑style protectionism might aim to bolster the US, but its ripple effects push investors elsewhere. In an uncertain era, predictability matters more than speculative upside. The UK real estate debt market—transparent, regulatory compliant, hosted on fintech platforms like ASK—is resonating precisely for that reason.

For investors seeking clarity in chaos, real estate debt offers the signal they need: steady, resilient, and ready for what comes next.

Table of Contents

- Introduction

- Why Protectionism Sparks Capital Flight

- Understanding Real Estate Debt

- How the ASK Platform Works

- A Compelling Shift in Capital Deployment

- UK Market Stability in 2025

- Why UK Real Estate Debt Is Gaining Traction

- Role of ASK Partners

- Targeted Investors—Especially Women

- Risk & Regulation Checks

- The Bigger Picture & Outlook

- Conclusion

Also read

For more details

- Europe Real Estate Debt Market Report – DWS

- JLL Global Capital Outlook – Debt in the Spotlight

- Aberdeen Investments – UK Real Estate Outlook

Thanks for reading. for more news please visit our website: insightafricareports.com